The Financial Crisis in American Hospitals: Operational Margins and Medicine

Ebrahim Barkoudah, MD

Operating margins in American hospitals have reached a critical inflection point, with profound implications for healthcare delivery and patient outcomes. Recent data reveal median operating margins plummeting below zero, threatening the foundation of healthcare quality and access. The relationship between hospital financial health and care delivery is intricate. It will necessitate synthesizing evidence to propose actionable solutions for maintaining healthcare delivery excellence amid financial constraints.

The Financial Precipice: American healthcare stands at a crossroads as hospital operating margins have deteriorated to levels unseen. Data from the American Hospital Association reveals a sobering reality: operating margins dropped to negative 0.2% in 2022, with over one-third of U.S. hospitals operating in the red. Safety-net institutions bear a disproportionate burden, forcing agonizing choices between financial sustainability and their mission to serve vulnerable populations.

Beyond the surface-level financial metrics lies a deeper crisis affecting patient care. Longitudinal analysis of 2,845 hospitals demonstrates that institutions operating below a 2% margin invest substantially less in quality improvement initiatives, technological infrastructure, and staff development. These constraints manifest in measurable outcomes, including increased emergency department wait times and higher readmission rates.

The Quality-Cost Paradox: Financial pressure creates ripple effects throughout healthcare systems. Rural hospitals illustrate this dynamic starkly, where declining margins have preceded service line reductions in 82% of cases. Essential but less profitable services, such as mental health care and obstetrics, face particular vulnerability. Urban safety-net hospitals shoulder additional burdens, with some reporting uncompensated care expenses exceeding $100 million annually.

Healthcare economics research suggests that sustainable hospital operations require margins between 2.5% and 4%. These thresholds enable crucial investments in infrastructure, technology, and workforce development. Current market conditions, including unprecedented labor cost escalation and supply chain disruptions, push many institutions well below these benchmarks. Contract labor expenses have surged 258% compared to pre-pandemic levels, while medical supply costs for average 300-bed hospitals now exceed $135 million annually.

Innovation and Quality at Risk: The relationship between financial health and healthcare innovation presents particular concerns. Hospitals operating with negative margins demonstrate 37% lower rates of implementing new evidence-based care protocols. Modern electronic health record systems, requiring investments between $50-200 million, become unattainable for financially stressed institutions. This technological gap affects not only operational efficiency but patient safety and care coordination.

Staffing ratios and professional development suffer under financial constraints. Data indicate that hospitals with negative margins maintain 12% higher nurse-to-patient ratios and invest $1,200 less per employee in annual training. These staffing pressures correlate directly with patient outcomes, showing a 0.8% increase in 30-day readmission rates for each percentage point decline in operating margin below break-even.

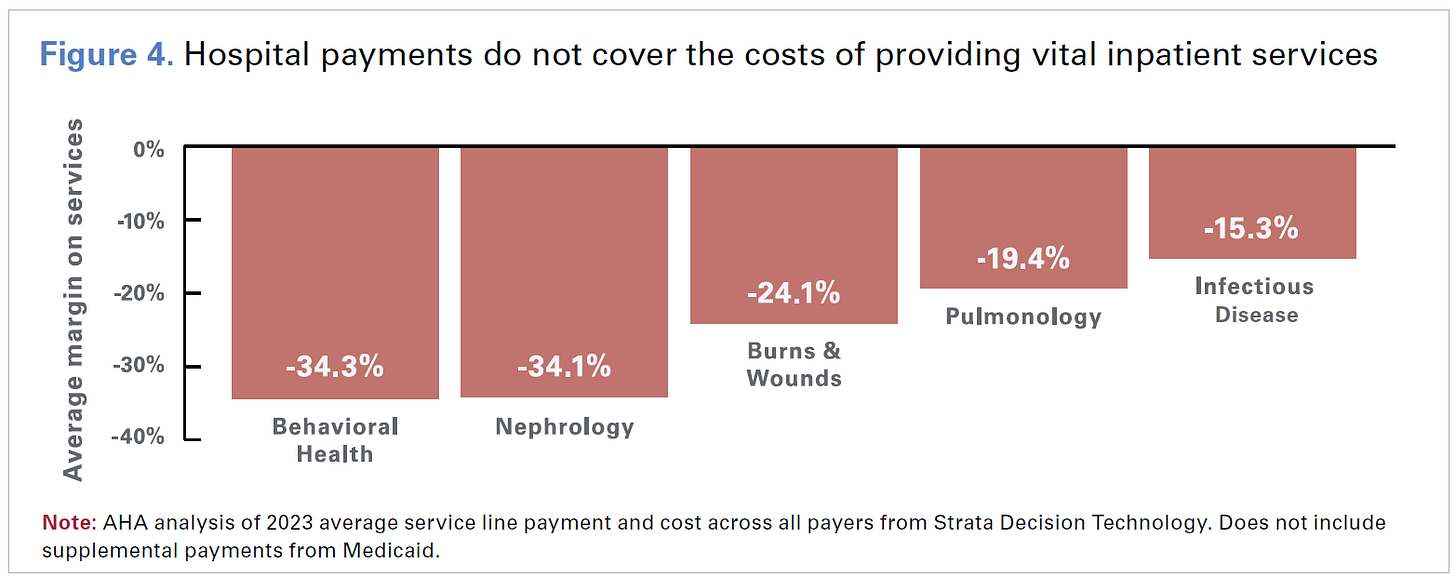

Economic Realities and System Sustainability: Medicare reimbursement patterns compound these challenges. Healthcare systems lose an average of $0.87 for every dollar spent treating Medicare patients, creating an industry-wide annual shortfall of $75.8 billion. Traditional cross-subsidization through commercial insurance has become increasingly untenable as Medicare populations grow and commercial reimbursement rates decline.

Value-based care models offer promising directions for reform. Evidence from Medicare's Comprehensive Care for Joint Replacement program demonstrates average savings of $1,687 per episode while maintaining quality metrics. Implementation costs average $1.2 million per facility but generate positive returns within 24 months. Similar success appears in operational efficiency initiatives, with Lean management programs showing returns of $9.3 million annually against $2.5 million in implementation costs.

Policy Imperatives and Future Directions: Addressing the current challenges requires coordinated policy responses. Payment systems must better reflect actual care delivery costs, particularly for safety-net and rural providers. Regulatory frameworks should incentivize innovative care delivery models that reduce unnecessary costs while maintaining quality standards. Targeted support for technology adoption and quality improvement initiatives must flow to financially vulnerable institutions.

The future demands careful balance between financial sustainability and healthcare quality. Success requires ongoing collaboration among providers, payers, policymakers, and stakeholders. Without intervention, projections suggest 600-1,000 hospitals face closure or significant service reductions by 2026. The stakes extend beyond individual institutions to the fundamental promise of accessible and sustainable high-quality healthcare delivery.

References

1. Medicare Payment Advisory Commission. Report to the Congress: Medicare Payment Policy. Washington, DC: MedPAC; 2023.

2. American Hospital Association. Hospital Statistics. Chicago: Health Forum; 2023.

3. Kaufman Hall. National Hospital Flash Report. Chicago: Kaufman Hall; 2023.

4. Ryan AM, Krinsky S, Maurer KA, Dimick JB. Changes in Hospital Quality Associated with Hospital Value-Based Purchasing. N Engl J Med.

5. Ly DP, Jha AK, Epstein AM. The association between hospital margins, quality of care, and closure or other change in operating status. J Gen Intern Med. 2011 Nov;26(11):1291-6.

6. Khullar D, Bond AM, Schpero WL. COVID-19 and the Financial Health of US Hospitals. JAMA. 2023;329(6):509-510.

7. Centers for Medicare & Medicaid Services. Medicare Value-Based Programs Achievement Report. Baltimore: CMS; 2023.

8. Gilman M, Adams EK, Hockenberry JM, Milstein AS, Wilson IB, Becker ER. Safety-Net Hospital Performance on National Quality Indicators. Health Aff (Millwood). 2022;41(4):551-561.

9. Berwick DM, Shine K. Enhancing Private Sector Health System Preparedness for 21st-Century Health Threats: Foundational Principles From a National Academies Initiative. JAMA. 2020 Mar 24;323(12):1133-1134.

10. Holmes GM, Kaufman BG, Pink GH. Predicting Financial Distress and Closure in Rural Hospitals. J Rural Health. 2017 Jun;33(3):239-249.

11. American College of Healthcare Executives. Hospital CEO Survey on Financial Sustainability. Chicago: ACHE; 2023.

12. Bai G, Anderson GF. A More Detailed Understanding Of Factors Associated With Hospital Profitability. Health Aff (Millwood). 2016 May 1;35(5):889-97.

13. National Rural Health Association. Rural Health Research Gateway: Financial Distress and Closure Analysis. Washington, DC: NRHA

14. Sommers BD, Maylone B, Blendon RJ, Orav EJ, Epstein AM. Three-Year Impacts Of The Affordable Care Act: Improved Medical Care And Health Among Low-Income Adults. Health Aff (Millwood). 2017 Jun 1;36(6):1119-1128.

15. Medicare Payment Advisory Commission. Hospital Inpatient and Outpatient Services Payment System Review. Washington, DC: MedPAC; 2023.

16. Friedberg MW, Chen PG, White C, Jung O, Raaen L, Hirshman S, Hoch E, Stevens C, Ginsburg PB, Casalino LP, Tutty M, Vargo C, Lipinski L. Effects of Health Care Payment Models on Physician Practice in the United States. Rand Health Q. 2015 Jul 15;5(1):8.

17. Agency for Healthcare Research and Quality. Healthcare Cost and Utilization Project Statistical Brief: Hospital Financial Performance Trends. Rockville, MD: AHRQ; 2023.